Beyond Canberra: Australia’s States Step-Up on Diplomacy

By Jeremy Costa

Master of International Relations student, University of Melbourne

This paper explores how each state and territory is engaging in the Asia-Pacific region economically and diplomatically. Through the lens of current partnerships, arrangements, and engagement strategies, it will identify the synergies and differences in approaches to their relationships in the region. While the focus remains on creating productive economic ties, the states and territories are increasingly becoming new diplomatic actors with unique interests in the region.

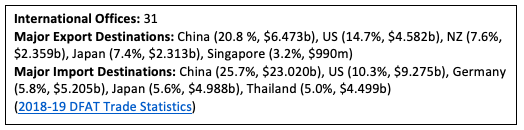

Victoria

*International offices include Global Victoria & Visit Victoria offices. Offices in London and Shanghai are shared, meaning there are essentially 29 individual offices.

*International offices include Global Victoria & Visit Victoria offices. Offices in London and Shanghai are shared, meaning there are essentially 29 individual offices.

Victoria is arguably the most active global actor of the states and territories with well-developed trade and investment strategies for China, India and Southeast Asia. Its independent agency, Global Victoria, promotes the state’s industry capabilities, pursues strategic partnerships and helps Victorian businesses to become more competitive in international markets. With 22 international offices, it also hosts the most overseas trade and investment postings.

Victoria has been particularly active in its relationship with its largest and most important trading partner, China. In 2018 Victoria became the first and only state or territory to sign a Memorandum of Understanding (MOU) on China’s Belt and Road Initiative. While it is a non-binding document, Victoria has come under scrutiny for signing the MoU with Prime Minister Scott Morrison stating that it is “inconsistent with the Australian government’s policy”. Nonetheless, Premier Daniel Andrews has stated that the arrangement is designed to complement Victoria’s state infrastructure program, “meaning more jobs and more trade and investment for Victorians”.

The MOU on China’s Belt and Road Initiative is only one aspect of Victoria’s growing economic relationship with China. Victoria’s China Strategy sets four 10-year targets to increase trade and investment, jobs and the number of visitors and students. According to its 2018 Progress Report, it has already achieved 2 of the 4 targets with an increase in Chinese investment in Victoria of 20 per cent and more than a 25 per cent growth in Chinese postgraduate enrolments. However, Victoria may suffer the consequences of Australia’s diplomatic row with China over its support of an independent COVID-19 inquiry. Namely, the Chinese ministry of education’s warning that students should reconsider travelling to Australia to study due to “incidents of discrimination” toward people of Asian descent could prove damaging for Victoria’s growing international education industry. Victoria also has an established sister-state relationship with the Chinese province of Jiangsu, with its ’40 Years of Friendship’ in 2019 marked by the Asialink Arts supported Victoria-Jiangsu Sister-State Artist Exchange.

Victoria also prioritises its relationship with India, reflected in the development of the 2018 India Strategy. The strategy sets ambitious 10-year targets to increase goods exports, postgraduate research students, Victorian business engagement and Indian visitor expenditure. Hosting 38 per cent of Australia’s Indian-diaspora, Victoria aims to utilise its strong cultural links to attract Indian business, students and tourists. In December 2019, Victoria announced plans for Indian tech giant Wipro Limited to establish a cyber defence centre in South Melbourne to create up to 100 jobs and open up internship opportunities for Victorian university graduates seeking a career in cyber security.

In 2018 the Victorian government also announced its Southeast Asia strategy, with Premier Daniel Andrews stating that it “aims to grow bilateral ties, promote Victoria and identify trade opportunities in education, tourism, agriculture and infrastructure in the region.” Recognising Southeast Asia’s rapidly growing markets, the strategy aims to grow professional service exports, Southeast Asian enrolments, visitor expenditure and inbound investment. Indonesia, Singapore, Malaysia, Vietnam and Thailand are identified as five countries of focus.

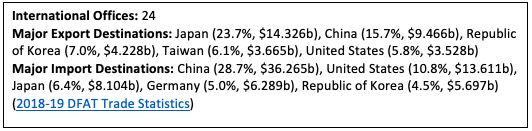

New South Wales

*International offices include both Invest NSW & Destination NSW offices. Offices in Shanghai, Guangzhou, London and Mumbai are shared, meaning there are essentially 20 individual international offices.

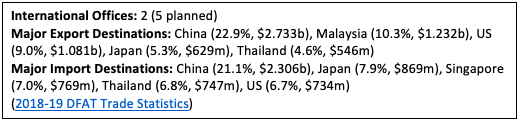

New South Wales is Australia’s largest economy and has extensive trade relationships with Asian countries. It has developed China and Japan strategies to guide its engagement with its two most important trading partners and has recently produced an ASEAN strategy to take advantage of Southeast Asia’s growing markets. With 11 Trade and Investment offices and 13 Destination NSW offices around the world, NSW is one of Australia’s preeminent global actors.

The NSW 2040 Economic Blueprint highlights the growth of Asia’s middle class as a major driver of its engagement and it presents Sydney as a “hub for education and innovation and for financial services in Asia”.

To complement the Blueprint’s objectives, the NSW government has developed an engagement plan for its major export destination, Japan. With the largest number of Japanese born citizens of any state or territory (34 per cent) and a 36-year sister-state relationship with Tokyo, NSW’s connections with Japan run deeper than any other state or territory. NSW also planned to help Japan deliver the now postponed 2020 Tokyo Olympics.

However, NSW recognises China as its largest trading partner, and it attracts the most Chinese foreign investment out of all the states and territories. Its China Engagement Strategy emphasises the important role that China will play in the NSW government’s $61 billion infrastructure investment program. With longstanding ties between governments, NSW utilises its sister-state relationships with Guangdong and Beijing to further facilitate the development of cultural and economic ties.

Like Victoria, NSW has also sought to expand its engagement to Southeast Asia. Its ASEAN Strategy, released in 2018, plans for 10% annual growth in its trade and investment relationship with ASEAN every year for 5 years. The Jakarta-NSW sister-state partnership, established in 1994, was renewed in 2015 with an agreement to work together on infrastructure (smart cities), education, economic development, public servants and zoological parks. In 2019, a delegation from the Parliament of Jakarta visited the NSW parliament to enhance cooperation on these areas.

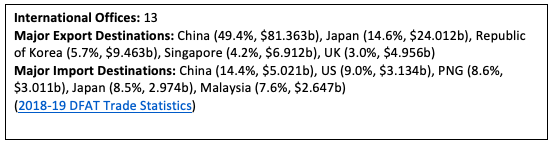

Western Australia

*International offices include both WA Trade and Investment & WA Tourism offices.

Unlike other states and territories, Western Australia has long been inextricably linked with Asia. This is largely driven by demand for its natural resources such as iron ore, which accounted for $76.413b of exports in 2018-19. WA has been active in protecting the interests of its most important Asian partnerships, even in times of diplomatic tension with the federal government.

WA’s Asian Engagement Strategy was launched in 2019 with key support from Asialink Business. Overseen by the Minister for Asian Engagement – the only dedicated Minister for Asia in Australia - the strategy recognises that key partners such as China and Japan will continue to drive economic growth in the mining and resources sector. However, reliance on these export industries leaves the WA economy exposed to external factors such as commodity price cycles, supply diversification and product substitution. To address these vulnerabilities, the strategy establishes Diversify WA – the state’s key economic development framework. While maintaining the development of WA’s important resource industries, Diversify WA aims to seek diversification in six key sectors: Energy; Tourism, Events and Creative Industries; International Education; Mining and Mining Engineering and Technical Services; Technology and Advanced Manufacturing; and Primary Industries.

Expanding into new markets is one avenue which WA will look to pursue as part of the framework. With the recent signing of the Indonesia–Australia Comprehensive Economic Partnership Agreement (IA-CEPA), there is hope that Indonesian markets will become increasingly accessible for WA businesses, primary producers, service providers and investors. At a recent event hosted by the WA JTSI, the panel noted that the IA-CEPA was particularly beneficial for WA, which accounts for 37 per cent of Australia’s exports to Indonesia. There are significant opportunities for WA’s food producers, investment in Indonesia’s tourism sector and infrastructure development.

Diplomatically, Premier Mark McGowan has been vocal in defending WA’s interests in Asia and has been particularly critical of the federal government’s handling of its relationship with China. In 2018 McGowan labelled then Foreign Minister Julie Bishop’s approach to China as “strange” and “frankly bizarre” in response to a diplomatic standoff between Canberra and Beijing over foreign influence laws. While defending Australia’s relationship with China amidst tensions over Australia’s support for an international COVID-19 inquiry, McGowan conceded that “whatever Australia's foreign policy is, we accept and agree with”. China’s decision to place an 80% tariff on barley imports in May, 88% of which come from Western Australia, demonstrates the vulnerability of the WA economy to tensions between the federal government and China.

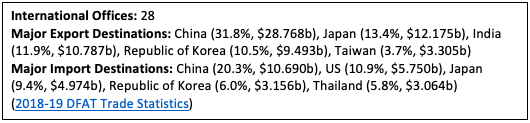

Queensland

*International offices include both Trade and Investment Queensland & Tourism and Events Queensland offices. Offices in London, Shanghai, Hong Kong, Jakarta and Tokyo are shared, meaning there are essentially 23 individual offices.

Queensland has significantly increased its global engagement in recent years to improve its economic competitiveness in the region. Queensland’s geographical proximity to Asia means it is uniquely placed to engage with Australia’s closest Asian and Pacific neighbours. Now hosting 15 overseas trade and investment offices, it also boasts one of the largest international networks of state representation.

While Queensland has traditionally focused on attracting Asian tourists, the state has recently sought to increase its economic outreach by implementing a $35 million Trade and Investment Strategy. The strategy boldly strives for Queensland to become “Australia’s most innovative and dynamic trading economy – a magnet for global investment”.

To deliver on these aims, Queensland has developed plans for several projects to attract Asian investment. One of the most ambitious schemes is the Sunshine Coast International Broadband Network. Projected to be operational by mid-2020, the plan includes the installation of a 550km undersea fibre optic cable which connects the Sunshine Coast to the 7000km Japan-Guam-Australia South (JGA-S) submarine cable. The network will contribute to Queensland’s vision of becoming a premier destination for international investment by allowing Queensland businesses to bypass Sydney and connect directly with Asia. The cable is projected to deliver up to 864 new jobs and stimulate $927 million in new investment in Queensland.

There is also space for Queensland to expand its economic engagement with Asia and the Pacific. For example, a recent report conducted by the Trade and Investment Commission found that Taiwan could be a prime target for Queensland agtech exporters. In the Pacific, experts such as Caitlyn Byrne from Griffith University and Dr Carl Ungerer, speaking at a Queensland AIIA event, have argued that Queensland should seek to leverage its geographic proximity, sector alignment and existing connections to establish closer ties with Australia’s Pacific Island neighbours.

Despite this increased focus on trade and investment, Queensland also continues to maintain and prioritise its tourism sector, which heavily relies on attracting Asian visitors. Tourism and Events Queensland (TEQ) has an especially active role overseas with 13 offices based largely in Asian countries. The Queensland Asia Tourism Strategy aims to project Queensland as “the leading Australian destination in market share, reputation and experience delivery for Asian travellers”. However, COVID-19 has significantly impacted Queensland’s tourism sector, which was contributing $27 billion to its economy and more than 230,000 jobs before the pandemic.

South Australia

*South Australia currently only has two Trade and Investment international offices active in Shanghai and Tokyo. The SA government has announced plans to open three new offices in Houston, Dubai and Kuala Lumpar.

South Australia’s presence in Asia is driven by its desire to improve in key economic indicators, which have historically underwhelmed. SA is focused on marketing itself as an attractive destination for Asian investors, particularly to distinguish itself from its larger economic neighbours in Victoria and NSW.

In 2019 New Zealand politician the Hon Steven Joyce was commissioned to lead a review of SA’s international and interstate engagement strategies. The review addressed SA’s economic competitiveness, which had fallen behind in its share of national income, employment and population. The economic opportunities provided by the growth of middle-income consumers across Asia was the focus of the review’s recommendations, particularly in priority sectors such as food and agribusiness, international education, tourism and energy and minerals.

A key initiative of the SA government’s push to improve its marketability in the region was the announcement of a $12.8 million investment to establish five new overseas trade and investment offices in Shanghai, Tokyo, Kuala Lumpar, Dubai and Houston. The announcement is also a major pillar in the government’s commitment to an annual economic growth target of 3 per cent.

South Australia has continued to prioritise its relationship with China by establishing a China Strategy Team to advise the state government on trade, investment, cultural and diplomatic issues. Demonstrating its longstanding ties to China, South Australia celebrated its 30 year partnership with the province of Shandong in 2016 by conducting a trade visit which featured 305 South Australian business leaders. It is wine that continues to drive the export market and with the support of the recently opened Shanghai Trade and Investment office, there was a notable 10.9% rise in wine exports to China from August 2018 to August 2019.

Chinese companies have also sought to invest in South Australia’s growing renewable energy sector, with Shanghai Electric Group in 2019 signing a strategic partnership with SIMEC Energy Australia to jointly build a renewable energy project in South Australia.

Northern Territory

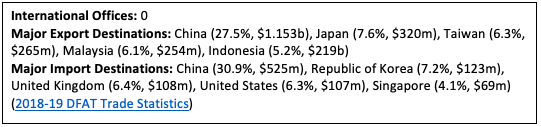

The Northern Territory’s proximity to Asia and its land, water and mineral resources drive its engagement opportunities in the Asia-Pacific. Despite its limited size and financial resources, the NT is well placed geographically to engage with Asia.

The NT’s International engagement, trade and investment strategic plan projects the region as the “the gateway between Australia and international markets”. In order to promote this representation to Asian countries, the NT Government has established “Team NT”, tasked with selling “Northern Territory’s (NT) investment, business and lifestyle prospects nationally and internationally”. These initiatives aim to attract new investment, create jobs and boost the population.

The NT recognises China as a source of growing collaboration, with specific interest in expanding international air links with Southern China. There is also growing collaboration in the education industry, with eight sister schools in the Chinese province of Anhui. However, the NT has not been spared from controversy over its relationship with China. Concerns over the long-term lease of Port Darwin to Chinese-owned company Landbridge in 2015 soured relations with the Federal Government, which was not consulted prior to the deal being signed.

The Northern Territory is also a driver of Australia’s relationship with Timor-Leste, which it identifies as a partner in priority sectors such as trade and investment, education, tourism and minerals – but also in diplomacy and engagement. It plays a key role in the Timor-Leste–Indonesia–Australia Growth Triangle (TIA-GT), a combined initiative of the regions of Eastern Indonesia, Northern Australia, and Timor-Leste that aims to boost trade, tourism and connectivity across the three regions. In 2016, the three regions met to discuss the possibility of developing a “tourism path” that would flow between Darwin, the Timor-Leste islands of Flores and Timor, and Bali.

Like other small economies in Australia, the NT is acutely aware of the need to market its unique qualities and capabilities in the region separate from the larger state economies. The South Australia-Northern Territory Strategic Partnership, signed in 2018, serves this purpose by bringing together the states to form “an international engagement, trade and investment action plan including collaboration on joint international trade missions”. The “One Road to Asia” initiative is a trademark plan of the partnership, which aims to project the regions as a freight and logistics hub for Australia and Asia.

Tasmania

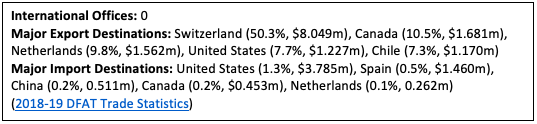

Tasmania’s international engagement is limited due to the size of its economy and limited resources. However, it is uniquely placed to leverage its expertise in renewable energy and its geographical proximity to Antarctica to become an important global player.

Recognising the shift in Australia’s focus toward Asian markets, Tasmania released ‘Tasmania’s Place in the Asian Century White Paper’ in March 2013. The paper aimed to fill the gaps of what was identified as a lack of engagement with the Asian region, reflected in its ranking as Australia’s worst economic performer in 2013. Since then, Tasmania has vastly increased its economic engagement with Asia, with China becoming its largest trading partner, accounting for over a quarter of its total international exports. In the most recent CommSec ‘State of the States’ report, Tasmania was ranked Australia’s best economic performer.

Tasmania’s Trade Strategy 2019-2025 identifies China and Hong Kong SAR, Japan, Singapore and Malaysia as five international markets for priority strategic engagement. Harnessing Tasmania’s expertise in renewable energy as a desirable export to Asian markets is noted as a priority. Tasmanian companies have already established commercial partnerships in the renewables sector in India, South East Asia and the South Pacific.

The Tasmanian Government has a nearly 40-year sister-state relationship with the Chinese province Fujian. Established in 1981, the relationship gives Tasmanian businesses an opportunity to engage in regular meetings and exchanges with stakeholders from the province. The importance of the relationship was reinforced in 2014 when Chinese President Xi Jinping chose to visit only Tasmania after attending the 2014 G20 Brisbane Summit. Xi’s visit brought significant attention from Chinese citizens and business to the region.

Tasmania is also focused on promoting Hobart as a world-class research and logistics hub for accessing Antarctica. Antarctic Tasmania, a dedicated branch of the Tasmanian government, provides policy and strategic advice on international Antarctic matters, participates in trade missions and supports Australia’s international engagement with other national Antarctic programs. Strategic interest in the Antarctic continent is increasing, particularly as China and Russia ramp up their presence. While Antarctica’s vast natural resources are currently protected by the ban on mining successfully negotiated in 1991, experts warn that Russia and China want to use Antarctica to create new GPS and mapping technology that threatens to militarise the continent. Tasmania will remain at the centre of securing Australia’s interests in the region as it becomes strategically contested.

Australian Capital Territory

The ACT aims to leverage the economic opportunities of being host to the capital city to drive its engagement with Asia. Like Tasmania, it also seeks to take advantage of its expertise in renewable energy.

The ACT’s International Engagement Strategy focuses on leveraging and marketing Canberra as a respected and globally connected city. The Office of International Engagement and its commissioner were established in tandem with the strategy to implement initiatives and coordinate the ACT’s international partnerships and programs.

The strategy identifies India as a future partner in trade and investment, although it is noted that significant tariff and administrative barriers remain. Until Australia concludes negotiations on a FTA with India, its focus is on building its profile in the Indian market, particularly in the form of international education and visitation partnerships.

Indonesia is also identified as a priority market, particularly in key capability areas such as education, ICT and healthcare. With the recent signing of the IA-CEPA, the ACT will look to increase its trade and investment opportunities in Indonesian markets.

Promoting investment in the renewable energy sector is also a focus of the strategy. The ACT has a ten-year lead on Australia’s other states and territories to achieving 100 per cent renewable energy. To harness this competitive advantage, the ACT wants to position Canberra as a world-leader in renewable energy development. Japan and the Republic of Korea (ROK) are identified as priority markets to explore renewable energy opportunities. Moreover, China’s increasing focus on research and development, particularly in collaboration with foreign research institutions, provides Canberran businesses and research institutions with an opportunity to capitalise on foreign investment in this space.

Conclusion

Australia’s states and territories are truly global actors and have unique relationships with major partners in the Asia-Pacific region. While Victoria, New South Wales, Western Australia, and Queensland are clear leaders in this space, mainly due to their compatibility with and reliance on Asian economies, all of the states and territories have ramped up their presence in the region in recent years.

China continues to be the relationship of focus as the largest two-way trade partner for six of the eight states and territories. While it will undoubtedly remain a crucial economic partner nationwide, the effects of the federal government’s diplomatic standoffs with China may cause unease as the economic effects reverberate to the states and territories.

Meanwhile, a growing focus on Southeast Asia, highlighted by the increasing number of engagement strategies, may signal an attempt to diversify the states’ and territories’ economies. However, this predominantly reflects a growing recognition of the untapped potential of Southeast Asian markets.

While the federal government retains control over foreign policy, the states and territories undoubtedly contribute to fostering productive relationships with Australia’s most important neighbours.

Jeremy Costa is an intern at Asialink, completing his Master of International Relations at the University of Melbourne.

Banner image: Victorian Parliament House, Melbourne, Australia. Credit: Leonid Andronov, Shutterstock.